Building a Black-Scholes Calculator: Learning by Doing

I wanted to understand the Black-Scholes model — not just memorize the formula, but really get it. So instead of reading ten tutorials, I decided to build a calculator from scratch using Python and AI support.

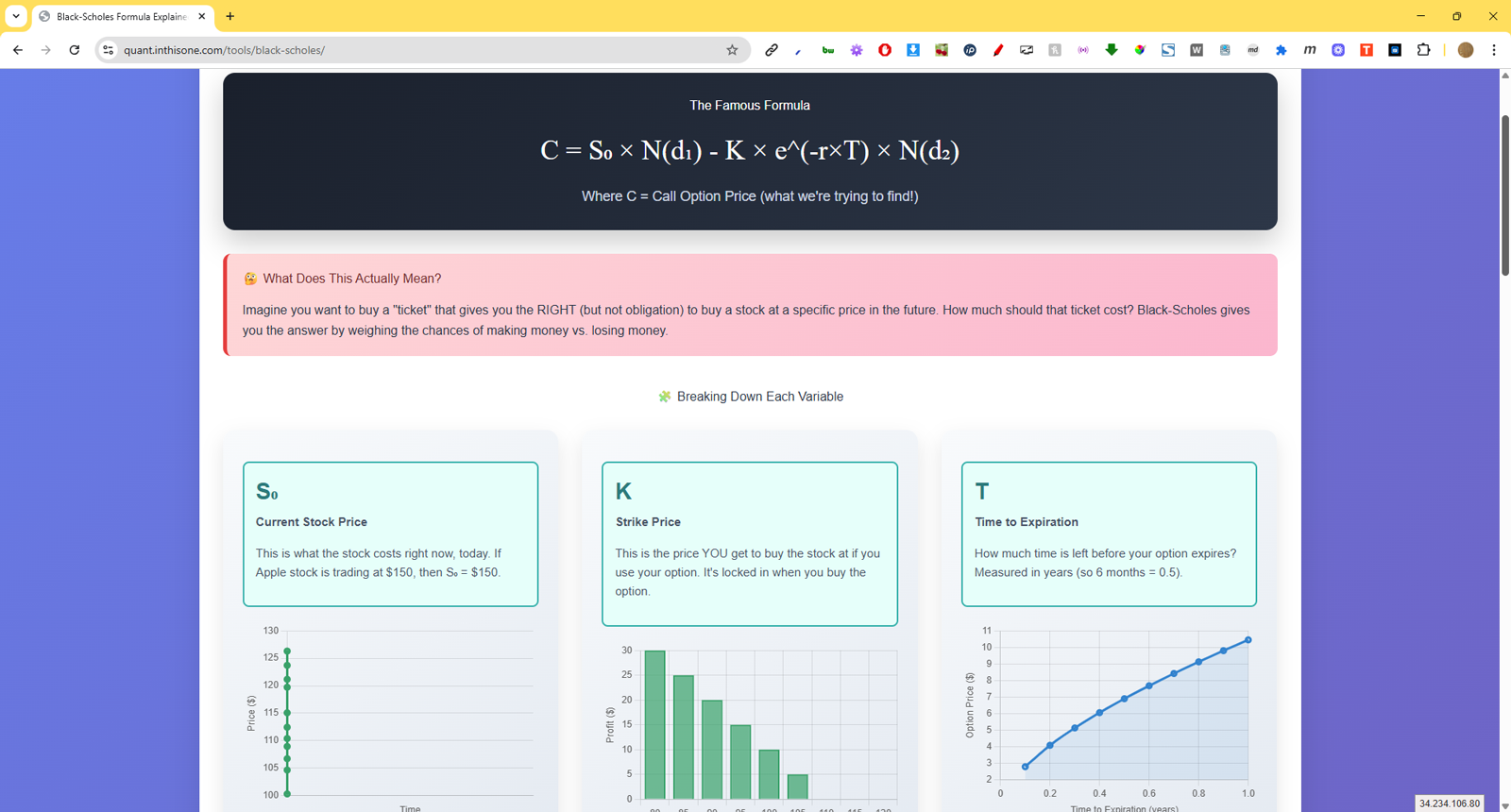

What is Black-Scholes and Why It Matters

The Black-Scholes model is a mathematical formula used to price European-style options. Developed in 1973 by Fischer Black and Myron Scholes (with Robert Merton's contributions), it revolutionized options trading by providing a theoretical framework for pricing options. The model's impact was so significant that Scholes and Merton received the Nobel Prize in Economics in 1997.

The formula looks intimidating at first:

$$ C = S N(d_1) - K e^{-rT} N(d_2) $$

$$ P = K e^{-rT} N(-d_2) - S N(-d_1) $$

Where:

$$ d_1 = \frac{\ln(S/K) + (r + \sigma^2 / 2)T}{\sigma \sqrt{T}}, \quad d_2 = d_1 - \sigma \sqrt{T} $$

But each component has a clear meaning:

- S: Current stock price

- K: Strike price

- T: Time to expiration

- r: Risk-free interest rate

- σ: Volatility

- N(): Cumulative normal distribution

Why I Built This

My motivation came from three main sources:

- Curiosity: I wanted to understand how options pricing actually works, not just read about it

- Hands-on Learning: Building something forces you to understand the details

- AI Partnership: I used AI to help generate the initial code, then iteratively refined it

The process of building the calculator taught me more than any textbook could. I had to:

- Implement the mathematical formulas correctly

- Create an intuitive user interface

- Add real-time updates and visualizations

- Handle edge cases and error conditions

The Development Process

I started with a basic Python implementation of the Black-Scholes formula, then added:

- Interactive sliders for all parameters

- Real-time price updates

- Visual charts showing the impact of each parameter

- Detailed explanations of the underlying mathematics

The most interesting part was seeing how each parameter affects the option price:

- Higher volatility increases both call and put prices

- Longer time to expiration increases option values

- Higher interest rates increase call prices but decrease put prices

Learning Outcomes

Building this calculator taught me several valuable lessons:

- Understanding vs. Memorization: Building something forces you to understand the underlying concepts

- AI as a Learning Tool: AI can help generate initial code, but you need to understand it to improve it

- Visual Learning: Interactive visualizations make complex concepts more intuitive

- Practical Application: Real-world implementation reveals nuances that theory alone doesn't show

Try It Yourself

You can try the calculator at quant.inthisone.com/tools/black-scholes or view the source code on GitHub.

Next Steps

This project has sparked my interest in other quantitative finance topics. I'm planning to explore:

- More complex options pricing models

- Greeks and risk management

- Portfolio optimization

- Machine learning applications in finance

Remember, the best way to learn is by doing. Don't just read about quantitative finance — build something!