Introduction

An interactive calculator for pricing European call and put options using the Black-Scholes model. This project was born out of a desire to deepen my understanding of derivatives pricing through building, not just reading.

Why I Built This

To apply first-principles thinking and experiment hands-on with financial models. I used AI to help generate the initial code, then iteratively tested, refined, and expanded it — combining human insight with AI assistance to better understand the math behind option pricing.

Key Features

- Real-time Black-Scholes pricing for call and put options

- Inputs for spot price, strike, volatility, interest rate, and time to maturity

- Clean UI with immediate results

- Fully open-source and hosted online

Technical Implementation

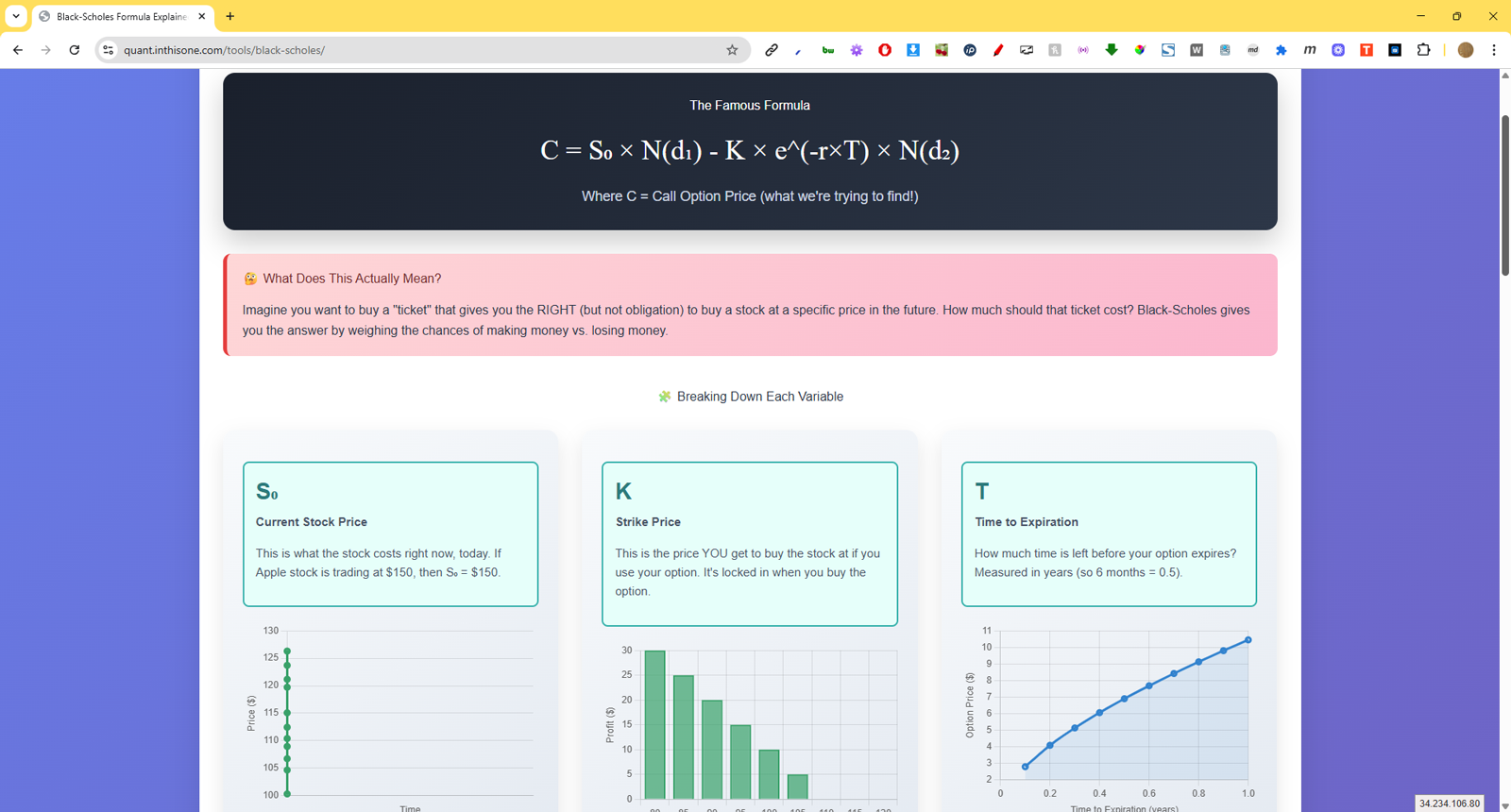

The calculator uses the standard Black-Scholes formulas:

Where:

The implementation includes:

- Interactive sliders for all input parameters

- Real-time price updates

- Visual charts showing the impact of each parameter

- Detailed explanations of the underlying mathematics

Learning Outcomes

This tool reflects my approach to learning quantitative finance — by building practical tools, collaborating with AI, and working through complexity one model at a time. The process of building this calculator helped me:

- Deepen my understanding of option pricing theory

- Practice implementing complex mathematical formulas

- Learn how to create intuitive visualizations of financial concepts

- Experience the value of AI-assisted development in learning complex topics

Try It Out

You can try the calculator at quant.inthisone.com/tools/black-scholes or view the source code on GitHub.