Background

I found Engineers Gate's work on systematic equity strategies and got hooked. I dove down a rabbit hole. I learned quant dev was a steep curve. Web dev, data engineering, DevOps, finance, math—all in one field. I realized quants don't start as experts. They learn as they go. I thought, "Can I do this?" I love a challenge. I organized notes in Obsidian and saved code and formulas in Markdown. That helped me learn concepts quickly.

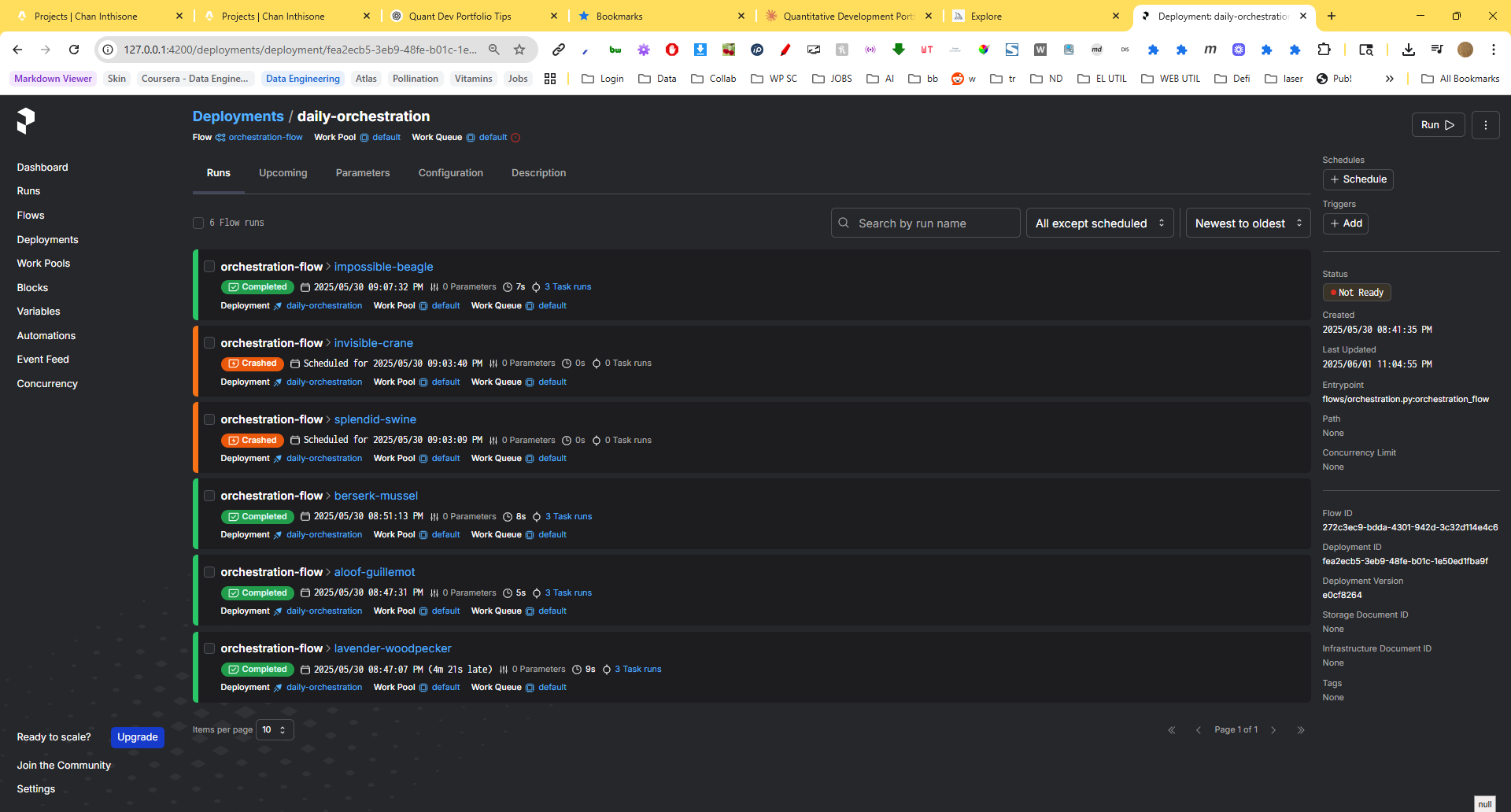

Pipeline

+--------------------+

| Data Ingestion |

+--------------------+

|

v

+--------------------+

| Data Lake (Raw) |

| - CSV / Parquet |

+--------------------+

|

v

+--------------------+

| Feature Engineering|

| - Rolling Returns |

| - Yield Curve Diff |

| - Sentiment Scores |

+--------------------+

|

v

+--------------------+

| Modeling |

| - Prophet / LSTM |

| - Regime Clustering|

+--------------------+

|

v

+--------------------+

| Backtesting |

| - Custom Strategy |

| - Metrics Output |

+--------------------+

|

v

+--------------------+

| Signal Output |

| - Buy / Sell Flags |

+--------------------+

|

v

+--------------------+

| Execution (Opt.) |

| - Alpaca API |

+--------------------+

Challenges & AI Help

I hit countless errors building this. Nights went by debugging. AI was my lifeline. It guided me through model tweaks and data bugs. When it finally ran, I felt unstoppable.

Results & Next Steps

I backtested 2012–2024 data. The strategy returned 12% CAGR with a Sharpe of 1.3. I plan to revisit each code section using AI to deepen my understanding. Next, I'll add IBKR integration and learn to code strategies in C++. I'm proud I pulled this off. I'm just getting started.